Gstn Clarification On Works Contract Or Crematorium Services And Funeral Services

GSTN Clarification on works contract or crematorium services and funeral services

Gst On Renting Of Residential Dwelling Unit

GST on Renting of Residential Dwelling unit,

Online Top Chartered Accountants In India

Online Top Chartered Accountants In India, Accounting services available in India, Tailored bookkeeping and accounting services in India

Whether The Constitution Of Nfra Is Constitutionally Valid?

Whether the constitution of NFRA is constitutionally valid?, Purpose of constitution of National Financial Authority, every company to appoint an statutory auditor to carry out audit of the FS of the Company.

Csr Spending In Covid – 19 Pandemic

CSR spending in COVID – 19 Pandemic, CSR Provisions on Foreign Companies, Portal For CSR Contribution, Contribution made to COVID–19, Expenditure on COVID jabs be considered as CSR Activity, FAQs on CSR Spending

Faqs On Gst Input Tax Credit

What are the Conditions to avail GST Input Tax Credit, What's fundamental measure to assert GST Credit?, During which case Goods or Services on which GST Input tax credit isn't available?

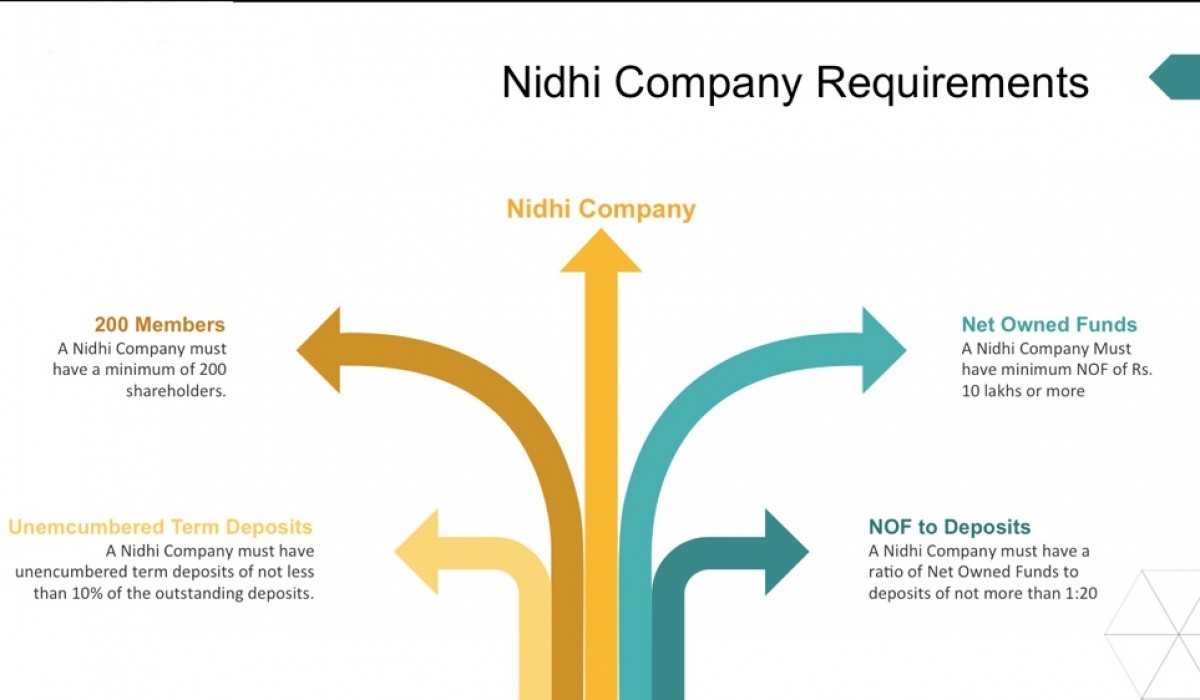

Nidhi Company Incorporation Procedure In India

Nidhi Company Incorporation Procedure in India | Documents Required for Nidhi Company Formation| Nidhi Company Registration Procedure |

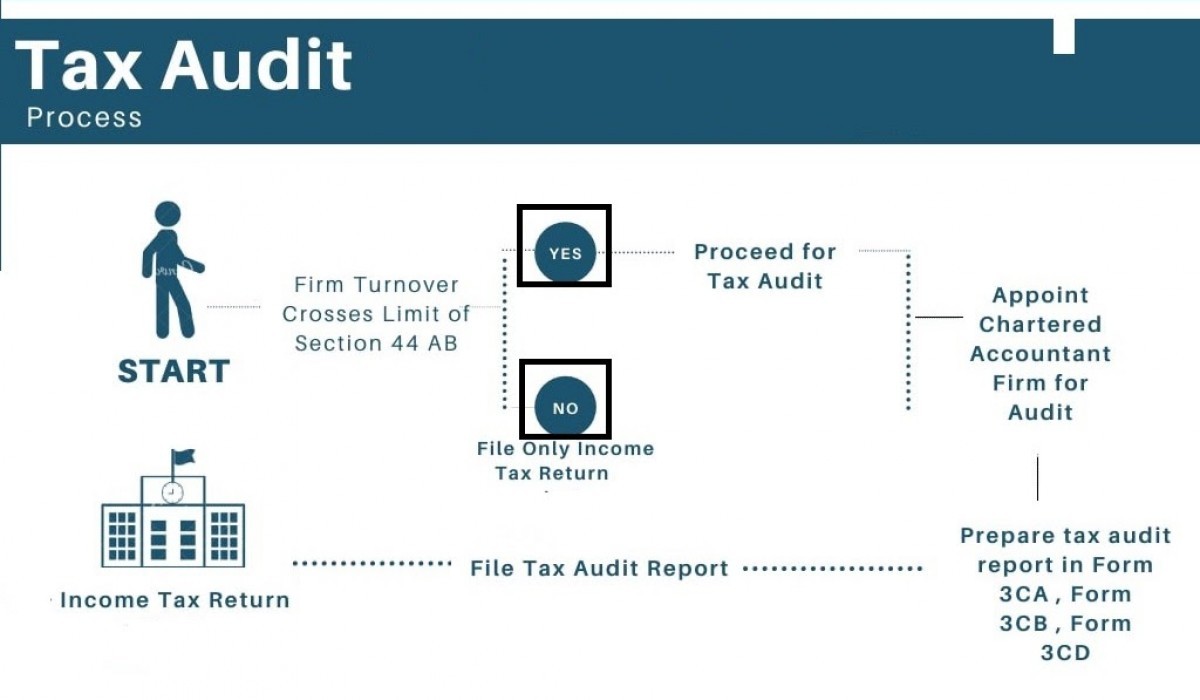

Faq On Presumptive Taxation- Section 44ad, 44ada, 44ae For Business And Professions

Presumptive Taxation- Section 44AD, 44ADA, 44AE